By understanding, identifying, and mitigating the common problems inherent in the decision-making process, we can make better choices and gain greater confidence.

By understanding, identifying, and mitigating the common problems inherent in the decision-making process, we can make better choices and gain greater confidence.

When making important decisions, such as whether to make an investment, how to deal with certain income taxes properly, whether to move, what do to about a new or current job, or how to respond to sharp declines in financial markets (or sharp appreciation), a common process goes as follows:

Common Decision-Making Process

- Encounter a choice (but narrow framing causes us to miss additional options)

- Analyze the options (but confirmation bias causes us to overemphasize aspects that reaffirm initial assumptions)

- Make a decision (but short-term emotion moves us to make the wrong decision)

- Live with it (but overconfidence causes us to forget to check our assumptions against the future that is unfolding)

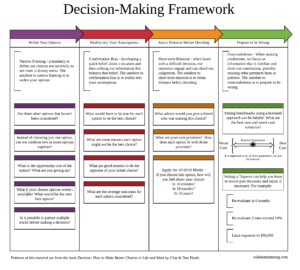

In the book Decisive: How to Make Better Choices in Life and Work, Chip and Dan Heath describe the WRAP method which. We have applied this to a decision-making framework.

WRAP Method

- Encounter a choice – Widen Your Options

- Analyze the options – Reality-check Your Assumptions

- Make a decision – Attain Distance Before Deciding

- Live with it – Prepare to be Wrong

Widen Your Options: Often an opinion is introduced as being between choices A or B, but only because other options were unknown or not considered. Avoid making a decision until you have expanded your option set.

Reality-check your Assumptions: It can be very difficult to overcome confirmation bias on your own. Have a trusted, objective party play the Devil’s Advocate to help you reality-test beliefs. This helps remove some of the emotional charge from the decision.

Attain Distance Before Deciding: Short-term emotion can cloud judgment. Which choice would you advise a friend to make? Consider how you will feel about this decision in the future (10 minutes from now, 10 months from now, 10 years from now).

Prepare to be Wrong: What if you make the wrong decision? Set benchmarks around expectations and design tripwires to trigger a review of the decision at key points. This can prepare you to be wrong and set in place a plan to make any necessary corrections.

One expectation clients may have of their financial planner is that we will help them reduce uncertainty around the future. While we can utilize a probabilistic approach to help narrow down what reasonable expectations are for the future, based on the past, we don’t have the proverbial crystal ball.

What we can do for our clients is to support and inform better choices. At times, we can act as a source of accountability. Our role is to offer good counsel, independence, and objectivity. We harness our experience of working with hundreds of other similar clients, along with education and experience in complex financial matters. We also study the science of humanities and how people can be supported in better decision making.

Author: Rebecca A. Barnes, CFP®, EA

Rebecca is a tax and financial planning practitioner with Callahan Financial Planning Company, serving clients in San Rafael, San Francisco, and Mill Valley in Northern California, in Omaha and Lincoln in Nebraska, and in the Denver metro area in Centennial Colorado.