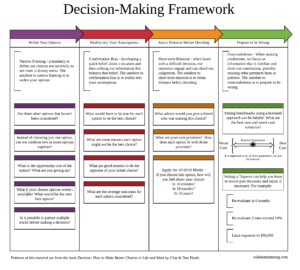

By understanding, identifying, and mitigating the common problems inherent in the decision-making process, we can make better choices and gain greater confidence.

By understanding, identifying, and mitigating the common problems inherent in the decision-making process, we can make better choices and gain greater confidence.

When making important decisions, such as whether to make an investment, how to deal with certain income taxes properly, whether to move, what do to about a new or current job, or how to respond to sharp declines in financial markets (or sharp appreciation), a common process goes as follows:

Common Decision-Making Process Read the rest of this entry »